Right now, firms everywhere are just about to begin filing their Form ADV. You can think of it as the “annual physical” for the investment advice business -- a time to check the vitals.

Should your firm update pricing? What can you commit to without needing to re-circulate an ADV to all your clients in an other-than-annual amendment? I’ve always wanted to look at that data to understand what firms are really doing by analyzing data with legal ramifications if they answer incorrectly.

That’s where this report comes in: State of the Financial Planning Profession.

This is not a survey based on opinions. We analyzed a massive, unbiased sample of what firms are legally reporting to the SEC.

The goal here is simple: I want to elevate the profession. I want us all to have the right information so we can make more intentional decisions.

Methodology & Data Sources

- ADV Part 1 data as of 1/2/2026. IAR details as of 1/12/2026.

- 23,686 firms

- 426,831 Investment Adviser Representatives. SEC Advisors (Exempt Reporting Advisers removed).

- Sources: SEC/State Firm and IAR Compilation, BLS 2024 Compensation Survey, SEC Firm ADV Part 2 Brochures (2021-2025).

Filters Applied (Total Firms Analyzed: 23,686):

- Filtered out firms with NO AUM or Financial Planning clients.

- Filtered out firms with NO investment advisors listed in Part 1.

- Must meet at least one: 1 retail/HNW client, lists financial planning services, lists retail portfolio management, or has at least 1 planning client.

This research is supported by Fin Pods AI, a Public Benefit Corporation.

The Difficulty of ADV Brochures

ADV Brochures contain interesting data that is hard to process since it is locked up in PDFs. Thankfully most advisors just copy forward their ADV’s so if we parse one year of your firm’s brochure, it’s likely we can process all of them.

In statistics, this is known as a high precision process which is different from accuracy. See this classic dartboard analogy:

High precision, not necessarily accurate, is great for comparisons. But even better, thanks to the hard work by the team at Kitces (see: How Financial Planners Actually Do Financial Planning), we can compare our independently discovered hourly planning fee estimate against theirs.

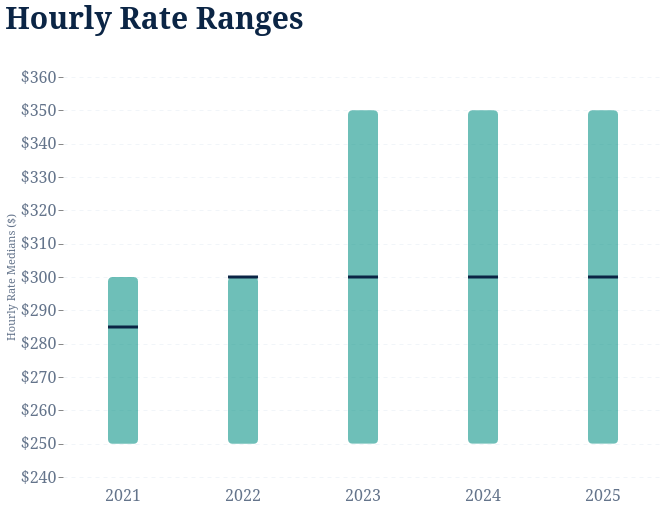

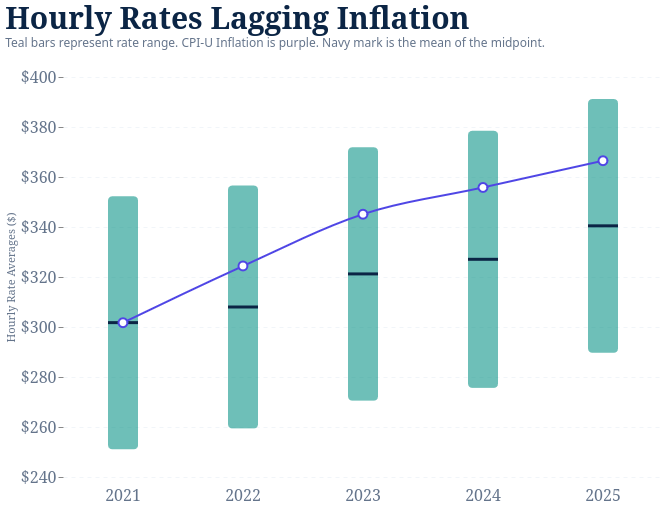

From our analysis, I found hourly rates to be in the range of $250 and $350.

Source: ADV Part 2’s, 6,204 ADV Part 2’s Parsed from 1,980 SEC Firms. The bottom of the bar charts is the 50th Percentile lowest rate offered by firms. The top is the 50th Percentile highest rate. The notch represents the 50th Percentile midpoint between lows and highs. ($200, $350, $400) -> $300 midpoint.

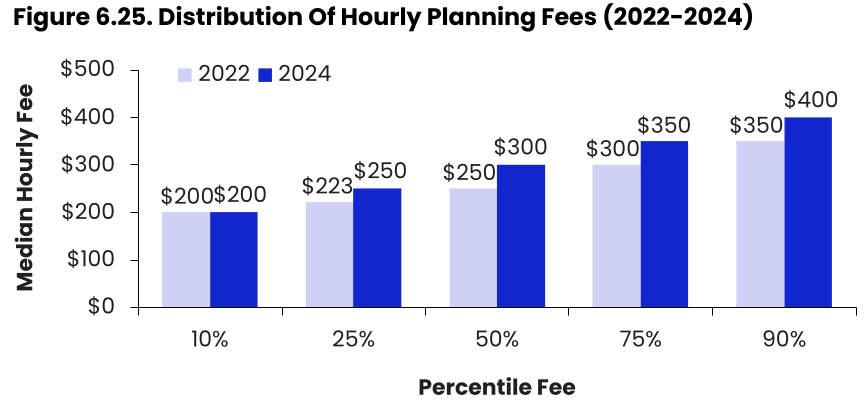

And here is the data from The Kitces Report (Vol. 2, 2024) where they plot just one number. We have a firm’s range of planning fees.

The Hourly Rate Consensus

For 2024, the Kitces Report (Vol. 2) 50th percentile (page 114) matches our midpoint exactly. In 2022 they say $250 was the median fee but we get $300. In 2021 we have ~$285. I am going to chalk that up to normal variance or us oversampling on SEC firms – which will be improved in a future report.

Now that we know we can trust the data, let's move on.

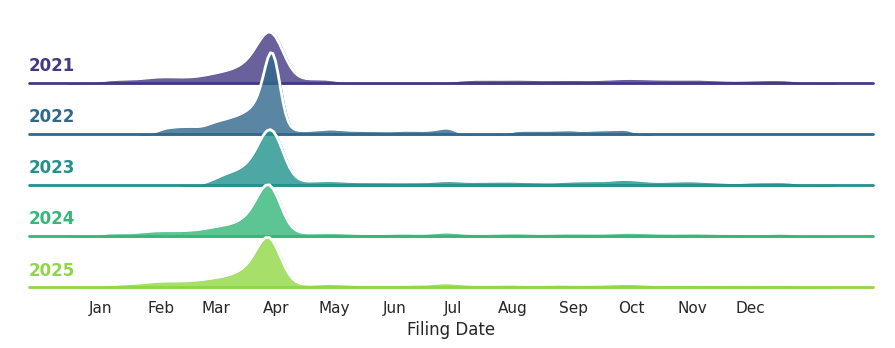

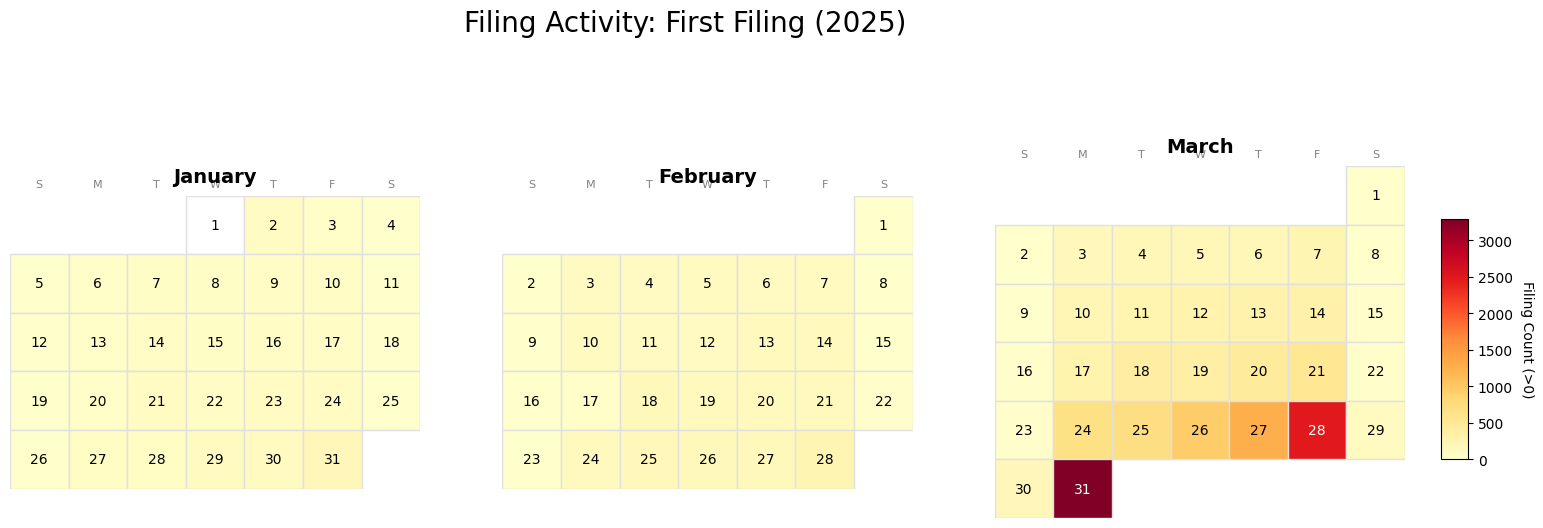

When Do Advisors Actually File?

First a fun one. I always see people post on January 2nd that they are all done with their ADV filings and I feel behind. Given the deadline for most firms is 3/31 we see a mad rush in March in the SEC data.

Click to expand

Surprisingly, only 25% of ADVs are filed by the first few weeks of March.

Quite the mad dash on March 31st! For state-registered advisors, I would expect to see a bigger spread. Bigger businesses are typically the ones with departments to do things as late as possible.

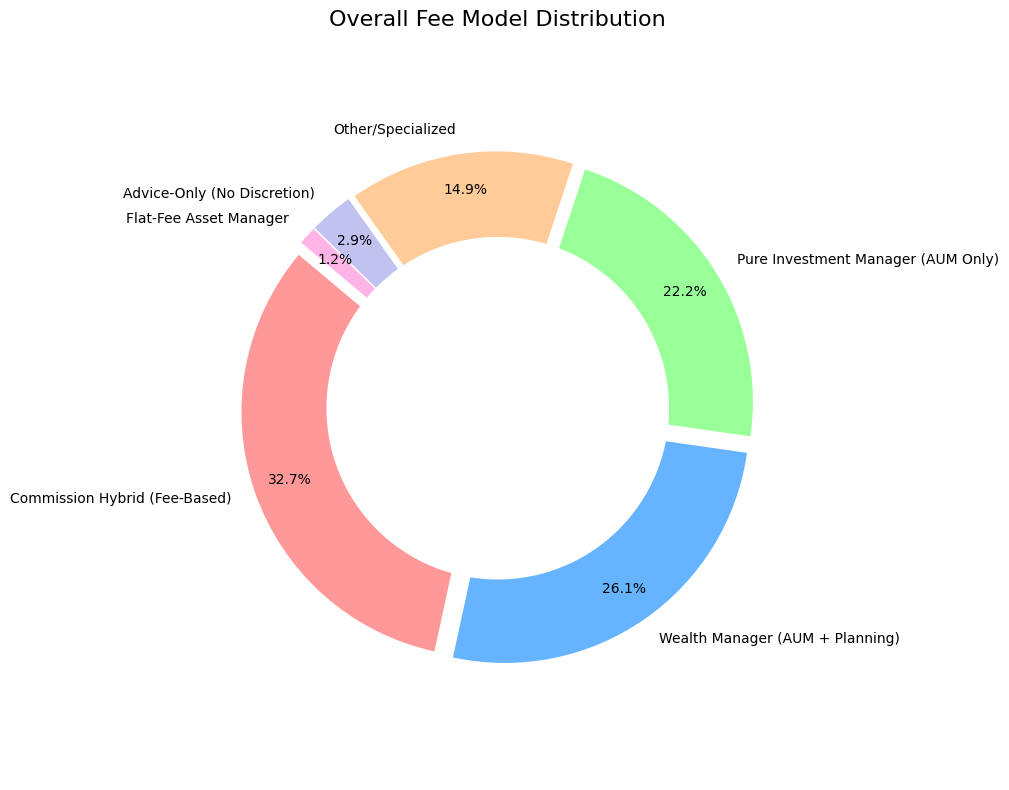

Most Popular Fee Models

Advice-Only is Small!

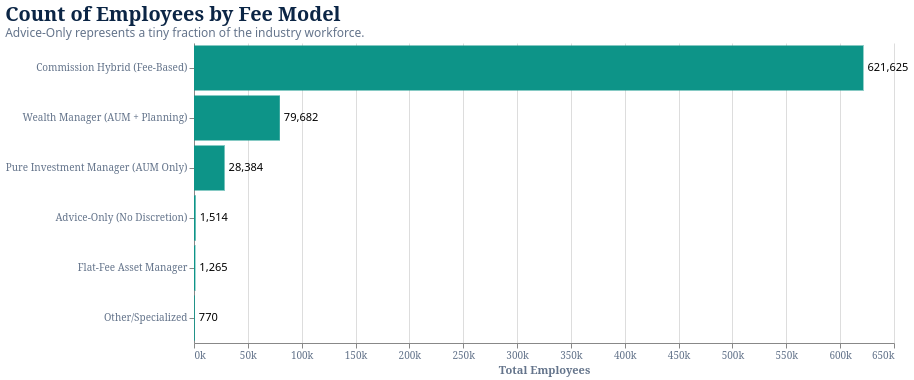

Financial Planning is Small When Weighted by Employee

Weighted by Employee

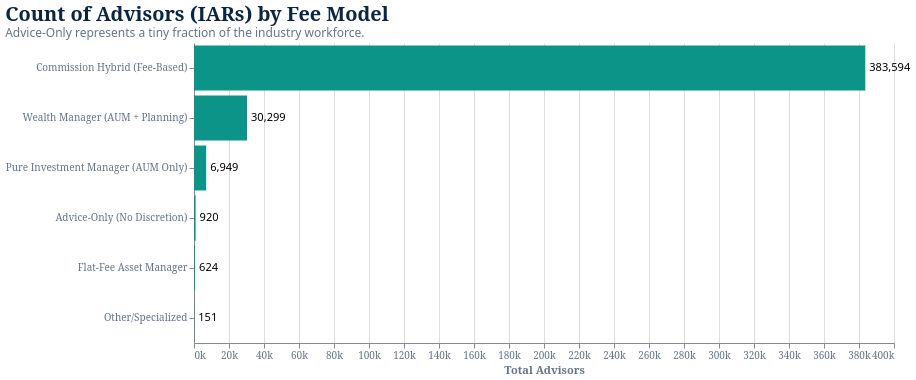

Advisors Registered (IARs)

Source: IAR Filings and ADV Part 1. Removed outliers claiming over 2 Million employees

"Maybe a protected term for 'financial planning' is warranted when planning-focused advisors make up less than 10% of IARs!"

Pricing

Hourly Rates & Inflation

The bottom of the bar charts is the average lowest rate offered by firms. The top is the average highest rate. I would expect the lower number to be more accurate in what they are actually charging as some firms list rates from $200 up to $2,500! The notch represents the average midpoint between lows and highs. ($200, $350, $400) -> $300 midpoint.

Prosperous Stagnation?

Firms are not keeping up with inflation! Another way to boost productivity while keeping wages depressed is through tech and efficiency, so this doesn’t necessarily mean profits are down. But "Prosperous Stagnation," as coined by Philip Palaveev, may be a very real thing as industry reports suggest net organic growth is stuck in the 3-4% range.

In 1,573 SEC firms, we found just 6% of firms (100 in total) increased their minimum hourly rate in 2025.

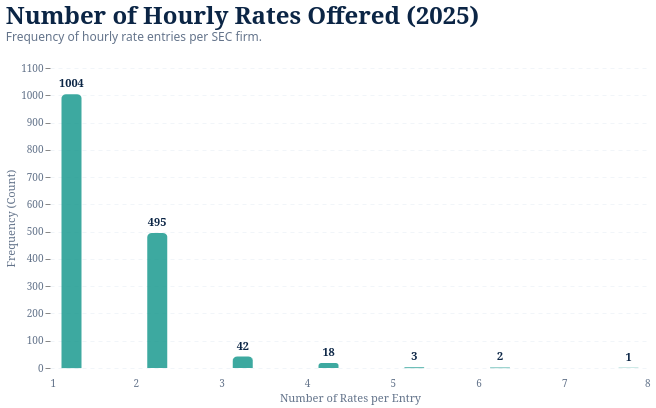

There is a very sharp decline after 2 hourly rates. As the industry matures and hourly-only firms get bigger, I would expect to see 3+ hourly rates become more common, similar to the structure of larger law firms.

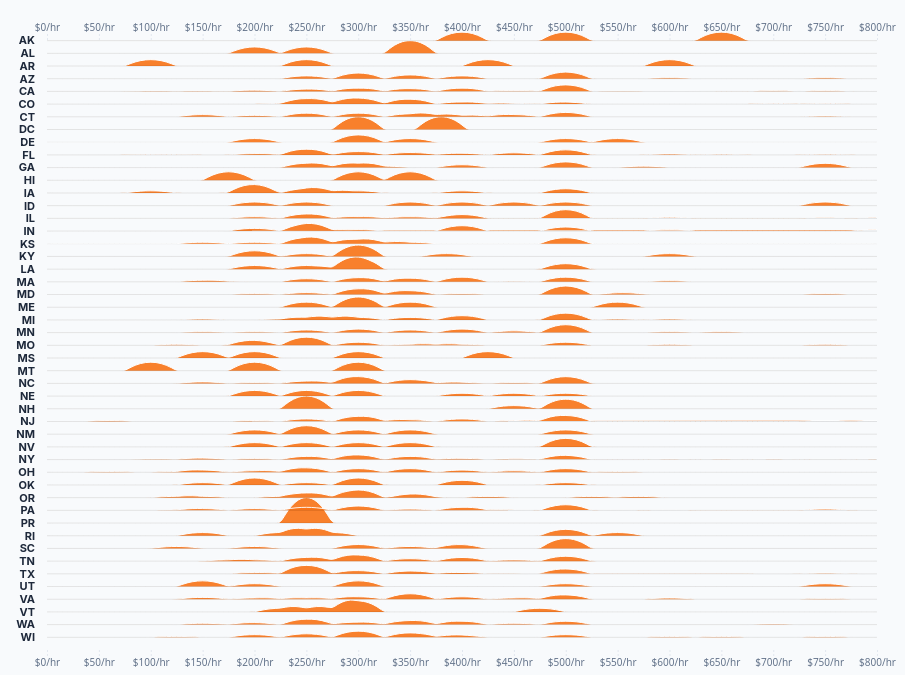

Hourly Rates by State

Joyplot/Ridgeline Plot

Popularized back in the 1970's by Joy Division, Joyplots, are great for comparing similar datasets. Our rendition is more similar to allergy tests showing sensitivies on a grid because we wanted to show all 50 states cleanly.

This shows either the lowest rate offered by SEC firms or the highest rate depending on the toggle you choose.

Data from 1,235 SEC Registered firms in 2025.

This hardly represents an efficient market, as rates appear to be set more psychologically rather than based on rich supply and demand dynamics. Notice the barrier at $500/hour across both the highest and lowest rates offered by firms.

US Map

Market Analysis

Key Geographic Insights

- • Alaska: Highest rates (small sample size).

- • California vs NY: California is just barely more expensive.

- • Utah vs Arizona: This surprised me. On closer inspection, Utah boasts a rate of 12.6% of households earning over $200,000 whereas Arizona is at 10.6% according to 2023 Census Data.

- • Overall this is mostly how I would expect.

Advice Is Personal

In our sample of 19 SEC-registered Advice-Only firms, we find a 50th Percentile of just 36.5 clients per employee (including support personnel).

When we look specifically at the advisors (IARs) assigned to the firm, the ratio rises to 142 financial planning clients per IAR. Interestingly, this nearly perfectly matches the commonly cited "Dunbar number" of 150. For context, when including the broader pool of 372 state-registered IARs, we find a much tighter average ratio of 33 clients per advisor.

Financial Planning Clients Per Employee

36.5

50th Percentile (SEC Advice-Only Firms)

Financial Planning Clients Per IAR

142

*Note: Data derived from Form ADV ranges. We smooth these ranges for calculation (e.g., a 1-10 range is assumed to be 4 clients; 11-25 is assumed to be 16).

Trends in Advice-Only & Tech

Advisor Networks

Nectarine did a brilliant thing to get around a major advice-only bottleneck, dealing with countless state securities laws. They hired 15 advisors from 15 different states so they could immediately be SEC registered! Bypassing the patchwork of inconsistently treated rules on testimonials and ADV Brochures that states demand.

AdviceOnly is a new network gearing to help Advice-Only planners be SEC registered and overcome messaging pitfalls plaguing the numerous groups. Even more exciting is that they are a Public Benefit Corporation just like us. Read more at their About page.

The "Build vs. Buy" Dilemma

Abundo Wealth/Eric Simonson started the Advice-Only Network. Abundo has undertaken the unusual but interesting step of building their own financial planning software to solve their biggest pain points with advice-only planning. Kudos for them pushing the profession forward and building a system they can rely on to deliver advice-only at scale!

As AI continues to improve, I expect us to see more and more of this internal software trend and have heard of more and more advisors building their own software but it’s rare to see something as polished as they have with a dedicated CTO in house alongside their 9 registered investment advisors.

For all the other firms, this is why FinTechs exist. You and other firm owners pay for software that you couldn’t create on your own. Benefitting from shared improvements. It will be interesting to see how AI affects this though. It’s possible to do things in hours that used to take weeks.

Maintenance Warning Be cautious on maintenance if you don’t have a full software engineering team. There is major key-employee risk if you don't scope that into your development process.

One Surprising Finding

The largest hourly-only firm has recently added a separate hourly rate for non-advisory work of $195/hour (client support). This solves a big issue with inefficient lead advisor time and plan implementation, a common critique of the hourly model.

The Custodian Data War

Summing it up in one sentence:

"Data lockup combined with a push to use their own in-house advisors."

Michael Kitces is asking 'serious questions' about whether XY Planning Network should keep Schwab as its exclusive RIA custodian for 2,000 firms after 'slap in the face – RIA Biz

Pontera's last-bid gambit to turn Fidelity credential-sharing ban into an 'investor rights issue,' falls flat, and now Schwab and others are turning a deaf ear as bans spread – RIA Biz

Vanguard has removed cost basis from their statements. – Bogleheads 2024

This makes it harder for advice-only planners to help their Vanguard clients

As we all seek to improve outcomes for our clients and elevate advice, these recent moves are chilling. What concerns me most is that these custodians can cut access for independent advisors and block us from having the data we need to be advocates for our clients. While AUM advisors generally have good access to discretionary account data, besides 401(k)’s, advice-only advisors feel this data challenge every time they work with a client. Especially advisors that go deep on tax strategy.

Custodians hide behind security in reducing easy access to data when the problem is decidedly not technical. It’s structural. As an advice-only planner, I’ve never needed full account numbers but I do need tax lots. No custodian I’ve dealt with makes that easy for clients to give.

Most advisors want to help more people. But the operational cost of compliance and intake forces them to keep fees high. Fin Pods AI exists to lower that structural floor by attacking both levers of the market as part of our Public Benefit Corporation mission.

New Custodians

Notably, Altruist is building vertical integrations starting as a custodian and branching out into an AI platform with their acquisition of Thyme and Jason Wenk Founder/CEO at Altruist, is an investor in FINNY, a client acquisition platform for advisors. They are the most exciting custodian by far for financial planners and I wish them success.

Drivers of Success: Coming May 2026

Join us in the next report as we use updated ADV Part 1 information to identify drivers of firm success: client retention, growth, and staffing increases.

Matteo Hoch

CFP®, EA, Founder

I started Fin Pods AI as a Public Benefit Corporation because I was a frustrated tax-focused, advice-only planner that came from tech. It is hard for an advice-only planner to advocate for our clients due to structural data issues holding us back from doing truly detailed tax and financial planning.